Introduction

The wealth of our Muslim nation is our industrious people.

The Ummah is at the centre of the world, “the middle kingdom”, and it owns the world’s most valuable mineral resources, on which the present and future political strategies of the world political powers continue to pivot.

Yet, for over a hundred years an insidious hand has been placed upon this nation in an attempt to cripple its existence. The tools to cripple Dar al-Islam were first economic and then military. These tools are still in use today.

An attempt to “Islamise” capitalism was introduced through a reformist group starting in Egypt, based on a puritanical and modernist reading of the Islamic Law. Our task is to return to the Islamic Model, based on the first community in Madina al-Munawwarah as an alternative to capitalism.

That original model is Muamalat. The full implementation of Muamalat means the establishment of an Islamic trading Bloc, based on our model of Trade and our currency: The Islamic Dinar and Dirham.

An Islamic trading Bloc, is therefore not just Muslims trading with each other using the present capitalist way of trade. An Islamic trading Bloc will consist of everybody, Muslims or non-Muslims, trading in the way in which Islamic Law defines Trade —Islamic trading.

The establishment of Islamic trading is a huge task that will eventually replace capitalism as a practice and Economics as its ideology. This establishment will need a careful planning in which the key infrastructure of Islamic trading will be introduced gradually. The minimum infrastructure that will allow all aspects of Islamic trading to be developed is, the Core Mechanism of the Islamic Trading Bloc.

The Return of the Islamic Dinar needs Islamic Trading

The Return of the Shariah currency, the Dinar and Dirham, poses a new understanding of wealth and prosperity that differs from conventional Economics. This new understanding is a new paradigm which we call Muamalat a significant part of which is Islamic trading. Islamic trading represents the wider frame in which the Islamic Dinar can operate as intended by Islamic Law. Only through Islamic trading can we realise the full potential of the return of the Shariah currency. The full implementation of Islamic trading proposes a completely replacement capitalism.

The return to Islamic trading is essentially a defence and enhance of trade. Why do we need to defend trade? Who/what is attacking trade? Trade has been abolished under the present legal and monopolistic order. To avoid misunderstanding we must clarify that what the World Trade Organisation (WTO) calls Trade, is not Trade in an Islamic sense, but is from an Islamic perspective what we might call monopoly distribution.

For trade to exist we need the need the return of some fundamental institutions now lost. The most important of those is the open/public market —Islamic market or suq— and second in importance, the caravans. The evidence of the return of trade will be the return of the caravans. We will elaborate further on this respect.

The “Islamisation” of Capitalism

Over the last fifty years a group of Muslims under the banner of “reform” has been engaged in what they call the “islamisation of knowledge”, the heart of which has been the “islamisation” of Economics.

Knowledge of Allah is unveiling from illusions of other-than-Allah. Hence knowledge is either Islamic or it is not knowledge at all. Knowledge cannot therefore be Islamised. Under the banner, the “islamisation of knowledge”, some scholars, taking knowledge for Western human sciences, undertook the ludicrous task of “Islamise” all human sciences: sociology, psychology, politics, anthropology and most important economics.

Islamic Economics produced Islamic banks, Islamic Stock Exchange, Islamic insurance, Islamic mortgages, and why not, Islamic credit cards.

Their methodology was simple. First, a rejection of the madhhab system, seen as medieval scholarship. Second, the transformation of the Shariah from its existential jurisprudence base into a normative set of abstract moral principles and values, that could be accessed at random. For example, the principles of equality and justice, seen as Islamic values, if assigned to any institution or financial procedure can serve to Islamise them.

The method resembles the famous statement of Father Ballerini, a leading Catholic on the eve of the christianisation of banks in the mid XIX century, who declared “the crime of usury depends on the intention of the lender”. Thus a 5% loan with good intention was declared faultless. Our modernist/reformist scholars have used the same “subjective moralising” methodology. The proof is in black and white in the existing Islamic Economics literature.

The problem with this moralising methodology is not just the mistaken tactics. The problem is that the islamisation of capitalism moved the focus away from our Islamic model. Thus, while this reformist ethos remains alive, the idea of the Islamic Dinar and Islamic trading will remain concealed.

Islamisation has reached a point of evident absurdity, a nihilistic conclusion, that is to say, “their” Islamic values have been diluted into a hollow pragmatism. The ironic result of islamisation is a full assimilation to capitalism, a kind of “reverse secularism”. How can Islamising result is the same institutions, tools and procedures as capitalism but with different words? This farce must end, because not only is a non-sensical exercise but it prevents the real Islamic model from ever returning.

We do not want to islamise capitalism, we want to create an alternative to it.

The End of Economics

Economics is not neutral, it is an ideology based on presumptions quite opposite to Allah’s injuction “Allah has permitted trade and has forbidden usury”. Economics reveals a different one, “Economics has forbidden trade and has permitted usury”.

The aim and methodology of Economics are not acceptable. We do not need to make them acceptable either, because we have a superior way of thinking emanating from the Sunna of the Messenger (May Allah bless him and grant him peace). We need to overcome this pseudo-science and create our own understanding outside their parameters. This is not Islamising Economics, but “ending” Economics.

The Danger of Mishandling the Sharia currency

We do not fear that the Sharia Currency will fail, but we fear people mishandling the Islamic Dinar and then blaming the Islamic currency for their own inadequacies.

What would constitute mishandling? Mishandling is what the Islamic Development Bank (IDB) did with the “Islamic Dinar”. IDB Islamised the special drawing rights (SDR is the currency created by the IMF to prevent gold from becoming a global alternative to the US dollar) and called it Islamic Dinar, now their unit of accounting. The formula: one Islamic Dinar = one SDR finished 14 hundred years of Islamic Currency history.

Mishandling means that the Sharia currency will turn into a marginal reserve of the banking system. Mishandling means that the Dinar is used to give a human face, perhaps an Islamic face to capitalism. Mishandling the Sharia currency is failing to understand that this is an opportunity to create an alternative to capitalism (being a haram system), and instead reduce the affair to a marginal and unsuccessful gold standard experiment. This will not work. We want to emphasise this point about “gold standard” because it is often presented as the solution to the present problems. We will explain later why this is not a solution.

The development of the Sharia currency relates to and is consistent with trade institutions, but not financial institutions. If the Sharia currency would be placed in the hands of financial institutions it would become, quite predictively, a marginal reserve and would therefore not fulfil its key role of wealth creation and establishment of the Sunna. The Shariah currency can only succeed with the full implementation of Muamalat.

Strategic Development, Not Size, Is The Issue

It is important to understand that the Shariah currency must be accompanied by the creation of an Islamic trading infrastructure in which it can thrive. This is to say that we need simultaneously to establish the architecture of Islamic trading. Coordination and planning is fundamental. More important a proper understanding of what the Sharia currency demands, and what it can do and cannot do for the economy.

The Sharia currency cannot succeed in isolation but it requires the development of all the trade institutions with which they co-existed and thrived in the past.

Why the Return to the Gold Standard is not Feasible nor Desirable

The Return to the Gold Standard is often mistaken as the Return of the Shariah currency. The mistake has a natural logical appeal: First there were gold coins, then paper that represented in part gold (the gold standard), and now there is only pure paper not backed by any specie of any kind. It is therefore logical but incorrect to imagine that since we came from the gold standard to the present situation we should return to the gold standard on our way to go back to gold.

Regarding the validity of the gold, its greatest strength is the fact that it is and it has been the best international money in history. The difficulty comes when gold is seen as interfering with the needs of management of the present debt economy by State institutions. Gold standard is seen by State instituons as being unfeasible or not practical because it does not allow the expansion of credit which is critical to the survival of the debt economy: unable to solve the problem of “there is no enough money” (which is mathematically an endemic problem of the debt economy), and the impossibility gold poses to “bail-out solutions”.

The problem is -and we will agree with them in this point- that you cannot slim a fat person by simply tightening a belt around his belly. The “solution” would kill him. Monetarists have blamed the “shortage of gold” as being the cause of all the economic crisis in the past. Their argument is that it does not allow for monetary expansion at the time of crisis. Since we are always in an state of crisis, or preventing a crisis, they see gold as a restriction in their primary concern “dealing with the crisis”.

Financial Markets need an occasional fix. It has always happened that way in the past. Earning money in the financial markets is wonderful: I sell you shares for 180, you sell them back to me for 210, I sell them back to you for 240, you sell them back to me for 270, etc. Both of us make money, but we have not added one iota of wealth or services to our community. Nevertheless, the GNP will reflect a growth due to the increase in value of the stock. This is the speculative money economy that drives the econometrics upwards. This speculative economy is more than 100 times bigger than the “formal” real economy. The problem is that when the stock reaches a point when there is no buyer, then the crisis comes. Why should there be a crisis? Why should the prices not simply fall, as with any other commercial item? Because the entire banking system is entangled in a chain of loans and collaterals reaches certain levels of the productive economy. In short, governments cannot afford the disarray, and they have to intervene in the only way they know, by pumping more money into the economy, bailing out the crisis with more paper.

How many times we have seen this scenario? The banking system has come out stronger and stronger after every crisis. Why? Because our politicians, in general, have been trained to think that the solution, always the same, consists of giving more money to the ailing market, relaxing the mode, one way or another, in which banks issue their credit.

In fact, we can say that we have been brought to our present type of economy driven by crisis, rather than by political consensus. The present monetary system, or lack of one –as stated by the Nobel Prize economist Robert Mundell-, came out of the bankruptcy of the US at the time of President Nixon in the early seventies, when he broke the last remaining elements of the old Gold Standard. Earlier, wars and revolutions paved the way to the first national paper currencies. Then it was crisis that widened the gap between physical specie and paper. Further crisis simply meant the gap grew wider, until finally, the leading capitalist nations resorted to this new arrangement of floating currencies, to the delight of speculators, who gave rise to an industry of 3 trillion dollars daily, taking full advantage of the chaos.

We would agree with monetarists that “to prevent the crisis” or “to manage the crisis” gold does not offer solutions. If that were the whole issue there would be nothing more to say, and the argument for gold would be finished –which is what monetarists want. But there is more to say about gold. First, the nature of the crisis is not addressed when we merely try to solve its symptoms. And second, we understand that there are certain sectors of the economy, different from the dominant speculative money economy, that could benefit from the use of the Shariah currency. Those sectors are essentially what are now known as the “real economy”. While gold does not help the speculative money economy, gold can help to activate the real economy which is often seen as a marginal sector, even though they are the lifeblood of the economy and their contribution to employment is overwhelmingly more important than the financial sector. Our argument is that gold does not relate to financial institutions and problems, but it relates to and will enhance the real economy and trading.

The debate between monetarists and gold standard economists is well known. The last time the debate erupted was in the late sixties and early seventies, after the French President De Gaulle announced his desire to see an European currency order based on gold to counteract the “excessive” power of the dollar. The arguments of every side are quite routine. The gold standard supporters say: justice, universality, no inflation, limit the power of banks, etc; the monetarists say: pragmatism in dealing with an economy in permanent crisis, gold is a restriction, it is expensive, it is not necessary for the primary tasks with which governments are more immediately confronted. This debate has been heard, and quite consistently for the last fifty years the monetarist have won it. At the end of the day, no government is going to sacrifice their immediate imperative necessities, and the prospect of loss of industry and jobs, in favour of an intangible –as they see it- ‘future best world’.

Our point is that the unbalancing nature of banking in the economy (usury itself) is amplified with a real non-flexible currency, unless banking is proportionally contracted. We are saying the trying to preserve the speculative economy is not feasible without enhancing the real economy and that is only possible with a parallel contraction of banking, that is creation of credit. I am perfectly aware that I am overstepping conventional thinking, perhaps this picture will allow to understand the new paradigm:

This economy is based 99% on credit, our muamalat is based 1% on credit. The key to understand our paradigm is “we do not need credit”. Here comes the blasphemy to economists: “Credit is actually harmful”. Development must be associated not to credit and capital accumulation in private hands but to the establishment of common infrastructure in public institutions by means of legitimate forms of contractual agreement: ijarah, Shirkat and Qirad.

What we need, is to be able to create wealth without resorting to banking, without needing the banks. This is the turning point. The argument is that the question of money cannot be seen in isolation, because it is not, in fact, the core of the problem. The core problem is usury to which paper money is intensely attached. To take benefits from a just currency we have to be able to create an economy without usury, and this is the real challenge.

In the beginning of introducing the Sharia currency, we should allow for the co-existence of the two systems: banks will operate normally with their paper money while the Sharia currency is gradually introduced through trading institutions. Yet, it must be understood that the ultimate purpose of introducing the Sharia currency must be the elimination of usury, through a new re-understanding of the role of pure/open/Islamic trading.

The key to the successful introduction of the Sharia currency is the creation of new wealth that will be newly generated through the enhancing and expansion of trade.

The Case for the Sharia Currency

- The introduction SHARIA CURRENCY must be associated with the development of Islamic trading. The SHARIA CURRENCY will be associated with trade institutions which can thrive with it and not left in the hands of banking or financial institutions which will marginalise it.

- Islamic trading will generate a new economy, a new wealth from the expansion of trade itself both in quantity and quality. Therefore the introduction of the SHARIA CURRENCY will not be competing with the existing wealth of the economy, but we will be creating a new one.

- The SHARIA CURRENCY will be offered to the people as a choice not as a legal compulsion from the State Law. The SHARIA CURRENCY-based payment systems, such as e-dinar, should develop in accordance to a general policy of promoting Islamic Trading (thus avoiding usury), such as it is being done by the World Islamic Trading Initiative, and gaining gradually its place into the market as a practical service to people’s needs rather than being imposed to them through the Law.

The Real Economy

The real economy is the economy without usury. The real economy is the economy of the people who produce and trade honestly, creating wealth to their society in as much as they serve society. The real economy represents wealth generated by real people trading and producing real merchandise and services, sold in real market-places using real money.

The real economy has, in relation to the accounting methods of today, a formal and an informal reality. The informal real economy is the part of the economy where transactions are based on street trading, smallholder farmer production, and the labour of women to sustain households. The dynamism of informal economies sustains significant percentages of national populations, especially in developing countries. Nevertheless, their contribution is ‘invisible’ insofar as it is not counted in GNP or GDP growth. The formal real economy in which goods and services are produced and traded (and registered as part of the GNP), constitutes the visible part of the real economy. Usually ‘the real economy’ is defined as the ‘visible’ part of the real economy, which is the one that ‘counts’.

The Speculative Economy

The other part of the GNP is the powerful “money” or speculative economy, which arises from trading money in rapidly expanding pooled funds (e.g. pension and mutual funds). The volume of flows in the speculative money economy is about a hundred times greater than the volume of flows in the visible “real” economy.

The difference between the real and the speculative economy has also been defined in terms of productiveness as “productive” and “non-productive” economy respectively. This definition is a reflection of the fact that the speculative economy, which makes money out of money, such as the money created by speculative bubbles, is not a true productive force, and therefore it does not add real wealth.

The growing size and power differentials between these economies fuels social injustice and environmental destruction. According to the United Nations Development Program:

- The gap in per capita income (GNP) between the countries with the richest fifth of the world’s people and those with the poorest fifth widened from 30 to 1 in 1960, to 60 to 1 in 1990, to 74 to 1 in 1995;

- the fifth of the world’s people living in the highest income countries had 86 percent of world GDP, whereas the bottom fifth received only 1 percent; and

- half of the world’s population lives on less than $2 a day.

Through the use of computers, managers of the money economy rove the world and prey on national economies. In the series of crises in Asia, Russia and Brazil, we saw tidal waves of capital outflows devastate enterprises and livelihoods throughout entire nations.

With the rise of the speculative money economy, or “casino capitalism”, governments are weakened and marginalised. Through deregulation, governments transfer power to the so-called “market”. Some governments become more accountable to external investors and creditors than to their own citizens. Financier George Soros arrogantly observed how, these days, Presidents and Prime Ministers now court financiers and industrialists, not the other way around. Unelected financiers and industrialists are orchestrating the globalisation process.

The Effects of the Growth of the Speculative Economy

The most clear effect of the extraordinary growth of this speculation is the effect on poverty. This is the World Bank’s Report on Development Effectiveness.

The World Bank’s Annual Review of Development Effectiveness 1999 (p.17) finds increases in world poverty, inequality and instability. Some specific findings follow:

- In 40 percent of the countries, per capita income either failed to grow or shrank;

- In 25 percent, the share of the population in absolute poverty increased;

- In 23 percent, life expectancy declined;

- In 54 percent, the people experienced stagnating per capita income, rising poverty, declining life expectancy, or a combination of these events;

- In 85 percent, per capita income grew 1% a year or less in the 1990s; and

- In 59 percent, gross savings as a percentage of GDP were low (less than 10 percent) or declining.

In 1990, the World Bank adopted the “overarching objective” of poverty reduction. In 1999, the IMF declared that poverty reduction would, henceforth, be the objective of its programs as well. However, hard evidence illustrates that their policies confuse the success of the lending programmes with the reality on the ground.

Far from advancing growth and development of the world economy, so-called “globalisation” has in reality showed itself to be a form of unbridled predator capitalism, which has opened wide the divergence between financial titles and real economy on the one hand, and rich and poor, on the other, in an intolerable manner, both on the national and the international plane.

What is Islamic trading?

Islamic trading is trade conducted under Islamic Law. The most important prerequisite for the existence of trade is the existence of the Islamic Market. A key characteristic of Islamic trading is its openness to everyone. It restores a natural right to the individual, which is, the right to trade: everyone has access to trade for free in an fitting venue, such as the traditional Open/Islamic Markets. This right has rapidly disappeared with the malls, supermarkets and hypermarkets, and has become the privilege of few. For example, the five largest supermarkets in Britain control 2/3 of all retailing.

Trade cannot exist in a regime in which supermarkets control retailing. Our right to trade can only be granted when public markets are in place. Trading requires markets and without them trading becomes monopolistic distribution.

Islamic trading is opened to all: Muslims and non-Muslims.

Usury is the illness and trade is health. To restore health is not enough with suppressing the symptoms, we need to promote health (good eating, exercise), a healthy body. To promote trade is the effective way of eliminating our dependence in usury. Promoting Islamic trading will be a positive way to present Islam to millions of victims of capitalism. Islamic trading will be a way of calling millions of non-Muslims to to see a new face of Islam: muamalat.

Another Aspect of Islamic trading: The Guilds

Islamic trading is a complete recipe to stimulate and encourage independent entrepreneurship. An Islamic society is not a society of employees. In pre-capitalist societies, Muslims have lived and worked organised in guilds. Belonging to a guild was the norm in Muslim societies. Businesses relations thrived inside the guild (without the need of banks) enhanced by the existence of a shared productive infrastructure within the organisation. The individual requirements to establish new enterprises within the guild were all favourable.

The relationship employer/employee was replaced by master/apprentice. There was not ”working class” in the days of the guilds. Guilds were historically eliminated by legal abolition and by the removing of their rights in favour of a new set of State given privileges and monopolies; and also the accumulation of capital (credit money) in private hands produced by banking. Today free competition and free access to the market do not exist for all. Thus it is not seen as a problem. Islamic trading guarantee equal rights for all. Islamic trading will decisively contribute the re-establishment of the guilds, challenging the system of the modern corporation based on “one owner and 14,000 employees”. It will encourage new models of open production processes (guilds), where production is open to thousands of free small owners associated. This is also part of the wider framework of the Islamic trading Initiative.

Concerning this matter, it is important to point out that specially since the beginning of the 1990’s, quite a few corporations have understood partially the benefits of dividing their production processes into smaller units. Instead of one pyramidal structure with one source of decision, they saw the benefit of many autonomous units working in collaboration while competing among each other. Thus, Toyota now claims that there is not one Toyota but two thousand Toyotas. Asea Brown Boveri, the Swedish-Swiss engineering giant, has subdivided itself into 1,300 independent companies and 5,000 autonomous profit centres. Their prosperous success is forcing others to adapt to the same principle. The policies of decentralisation, though they seem a step in the right direction, are limited because they have all been designed by corporate staff. Corporate staff could not suggest the ultimate step which would be to eliminate the corporation all together, or in other words to give total independence to the autonomous workshops. That could only happen if the small workshop could have an identical access to the customer as Toyota itself. To make that step we need open distribution networks and free market-places for all. These is all part of Islamic trading.

Islamic trading can transform money, transform production and distribution, create a new formulation of contractual law and, perhaps the most important, open trading to all in society. Islamic trading consists of new procedures, mechanisms and institutions based on justice. But Islamic trading is not a moral proposition, it is existential reality. It does not judge your inner convictions but only your outward behaviour and the effects of your behaviour.

The Foundations of Islamic trading consists of five main elements:

- The Open Market-place: A market place opened to all.

- The Open Production process: A production accessible to all.

- The Open Distribution network: A distribution accessible to all.

- The Free Medium of Exchange: A medium of exchange freely chosen by all.

- The Islamic Business Contracts: The contracts that guarantee Islamic trading.

What is The Islamic Market?

Soon after his arrival in Madina al-Munawwarah, the Prophet of Islam, salla’llahu ‘alaihi wa sallam, created two institutions, a mosque and a market. He made clear by his statements and explicit injunctions that the marketplace was to be a space freely accessible to everybody, with no divisions (such as shops) and where no taxes, levies or rents could be charged.

The Market is like a Mosque: …

The Messenger of Allah, salla’llahu ‘alaihi wa sallam, said: “Markets should follow the same sunnah as the mosques: whoever gets his place first has a right to it until he gets up and goes back to his house or finishes his selling. (suq al-muslimin ka-musalla l-muslimin, man sabaqa ila shay’in fa-huwa lahu yawmahu hatta yada‘ahu.)”.

(Al-Hindi, Kanz al-’Ummal, V, 488, no. 2688)

it is a sadaqa, with no private ownership …

Ibrahim ibn al-Mundhir al Hizami relates from Abdallah ibn Ja’far, that Muhammad ibn Abdallah ibn Hasan said, “The Messenger of Allah, salla’llahu ‘alaihi wa sallam, gave the Muslims their markets as a charitable gift (tasaddaqa ‘ala l-muslimina bi-aswaqihim).”

(Ibn Shabba, K. Tarikh al-Madinah al-Munawwarah, 304)

with no rent charged …

Ibn Zabala relates that Khalid ibn Ilyas al-’Adawi said, “The letter of Umar ibn Abd al-Aziz was read out to us in Madinah, saying that the market was a sadaqa and that no rent (kira’) should be charged on anyone for it.”

(As-Samhudi, Wafa al-Wafa, 749)

with no taxes levied on it …

Ibrahim ibn al-Mundhir relates from Ishaq ibn Ja’far ibn Muhammad, from Abdallah ibn Ja’far ibn al-Miswar, from Shurayh ibn Abdallah ibn Abi Namir, that Ata’ ibn Yasar said, “When the Messenger of Allah, salla’llahu ‘alaihi wa sallam, wanted to set up a market in Madinah, he went to the market of Bani Qaynuqa’ and then came to the market of Madinah, stamped his foot on the ground and said, ‘This is your market. Do not let it be lessened (la yudayyaq), and do not let any tax (kharaj) be levied on it.’”

(Ibn Shabba, K. Tarikh al-Madinah al-Munawwarah, 304)

where no reservations or claims can be made …

Ibn Zabala relates from Hatim ibn Isma’il that Habib said that Umar ibn al-Khattab [once] passed by the Gate of Ma’mar in the market and [saw that] a jar had been placed by the gate and he ordered that it be taken away. … Umar forbade him to put any stones on the place or lay claim to it [in any way] (an yuhajjir ‘alayha aw yahuzaha).

(As-Samhudi, Wafa al-Wafa, 749)

and where no shops can be constructed.

Ibn Shabba relates from Salih ibn Kaysan …that …The Messenger of Allah, salla’llahu ‘alaihi wa sallam, …said: ‘This is your market. Do not build anything with stone (la tatahajjaru) [on it], and do not let any tax (kharaj) be levied on it’”

(As-Samhudi, Wafa al-Wafa, 747-8)

Abu r-Rijal relates from Isra’il, from Ziyad ibn Fayyad, from one of the shaykhs of Madinah that Umar ibn al Khattab, radiya’llahu ‘anhu, saw a shop (dukkan) which someone had newly put up in the market and he destroyed it.

(Ibn Shabba, K. Tarikh al-Madinah al-Munawwarah, 750)

Without Market Place there is no Trade

The first thing is that we need to distinguish between trade and monopolistic distribution. Supermarkets do not allow trade to happen, no one can go there to trade. The products that arrive at the supermarket have already been bought by the supermarket. The goods come from a warehouse that distributes them to the network of supermarkets throughout the nation. The goods arrive at the warehouse from producers or other warehouses, from where the goods were originally bought. This is not trade, this is monopolistic distribution.

The most clear evidence that trade has disappeared is that there are no caravans any more. Caravans are the institution of trade. There cannot be caravans if there is no where to go to sell. If there are no markets there will be no caravans. Therefore if there are no markets there is no trade.

To recreate trade we need to recreate Islamic or Open Markets.

Islamic trading generates “New Wealth”

Trade is in itself a source of wealth.

Rasulullah, salallahu alayhi wa sallam, said: “9/10 of the provision comes from trade”. That is like saying that 9/10 of the generation of wealth comes from trade. If this is so important to us, it is obvious that its defence is proportionally important. Considering that trade is no longer possible without market places, we can conclude that we have eliminated 9/10 of our provision. To re-establish trade must be considered a priority of every responsible government, and this primarily means the establishment of networks of Islamic Markets.

We are unfortunately living at a time in which people do not regard trade as something important. The result of this is that economists have concluded that traders should be eliminated from the economy in favour of distributors: supermarkets are encouraged while old markets are closed down.

Another result of this philosophy is that real traders are thrown into the streets with no infrastructure to support them (street markets), while bankers (usurers) sit in palaces. The reverse of this is the Islamic way. Umar ibn al-Khattab, radiallahu anhu, considered the traders that came to Madina, his guests. Consequently, all Islamic cultures have treated traders with great esteem. They build for them palaces in which to trade. See for example, the markets of Istanbul, Samarkand or Isfahan. In the past our traders were in palaces while the usurers were in the streets chased by the police. Today the reverse is the norm.

Traders are a source of wealth for us and adequate infrastructure should be given to them. This is what the Islamic market provides for them.

The important thing is that the Islamic Dinar associated to Islamic trading can generate new wealth with those people in society that economists reject. The Islamic Dinar can generate a new wealth with the rejects of the present economy, that is, the real economy.

The fate of the Islamic Dinar and the Real Economy are bound together through Islamic trading.

The Islamic Trading Bloc

The implementation of Islamic trading has its maximum political reality in the establishment of an Islamic trading Bloc. The establishment of the Islamic trading Bloc will have three conditions:

- It must be based on the use of the SHARIA CURRENCY as currency rather than the creation of yet another paper currency.

- It must be introduced gradually and should be offered as a choice to the Muslim community

- It must be accompanied by the establishment of a trading infrastructure based on Islamic Markets.

The Core Mechanism of an Islamic trading Bloc

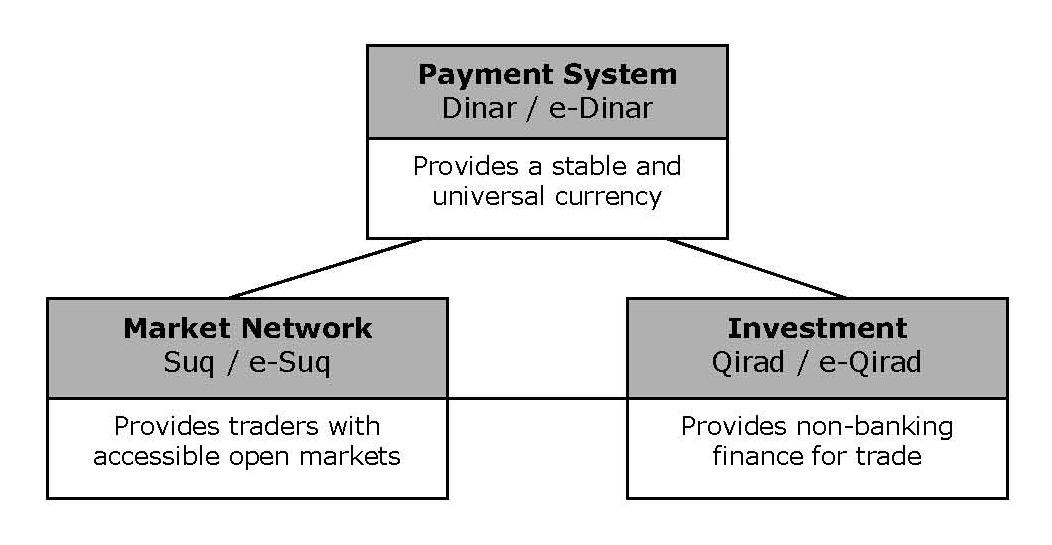

The minimum mechanism that can guarantee a sustainable and continuous growth of the use of the Islamic Dinar as currency consisting of three elements i.e. the Payment System, the Market Network and Investment (qirad).

All three elements enhance trade and synergise one another